Discover the top geopolitical risks set to affect the global supply chain this year.

In 2023—if it wasn’t already—geopolitics became top of mind for every procurement professional. With the ongoing war between Russia and Ukraine, the Israel-Hamas War, and the crisis in the Red Sea, the shockwaves these conflicts sent throughout their nations and the world have been felt everywhere—especially in the supply chain. As a supply chain manager, it is impossible (and unwise) to ignore the state of global politics, as it directly impacts nearly every level of the supply chain, from increased shipping rates to access to critical materials and minerals.

In fact, geopolitics is one of the top five supply chain megatrends this year, which we cover in our highly-anticipated annual report. This year, managers and procurement professionals must stay incredibly diligent when it comes to the latest news. In this blog, we uncover the top geopolitical supply chain risks of 2024 so you can proactively prepare your supply chain.

The attacks launched by Yemen’s Houthi group on cargo ships in the Bab al Mandeb Strait at the southern end of the Red Sea have caused several major global shipping and oil companies – including Maersk and British Petroleum (BP) – to suspend shipments and halt operations in the area.

Now, ships are avoiding Egypt’s Suez Canal, the shortest maritime route from Europe to Asia and one of the world’s most important waterways, which accounts for about 12% of the world’s shipping traffic. This is causing longer journeys, which have added costs, increased oil prices, and increased insurance premiums.

The Israel-Hamas war has posed a serious threat to the global supply chains. Ports in Israel, including the Port of Ashkelon, are strained, resulting in suspended operations and escalated ocean shipping premiums multiplied tenfold. If a prolonged shutdown occurs, it could squeeze the already tight global gas market. Additionally, the high-tech industry, one of Israel’s top GDP contributors, faces serious concerns as close to 500 multinational companies operate in Israel, including Intel and Tower Semiconductor.

Learn about the potential effects of the Israel-Hamas war across industries and commodities. This report shares our expert-backed best practices to protect your supply chain. Download the special report here: Israel-Hamas War: Expert Insights and Best Practices to Mitigate Disruptions.

The Russia-Ukraine conflict, now surpassing 700 days, has become a catalyst for global supply chain disruptions, aggravated by the imposition of sanctions affecting critical commodities like oil and natural gas.

Nations, including the US, the UK, Canada, Ukraine, and the EU, have enacted sanctions against Russia and price caps on Russian oil products. Given Russia’s pivotal role as a major exporter of energy and raw materials, these measures have reverberated across vital sectors such as energy, high tech, aerospace, defense, and transportation, amplifying the impact of the conflict on the global economy.

Read more about the sanctions against Russia and the supply chain impact: Russian Sanctions: Navigating Supply Chain Impacts and Potential Outlook.

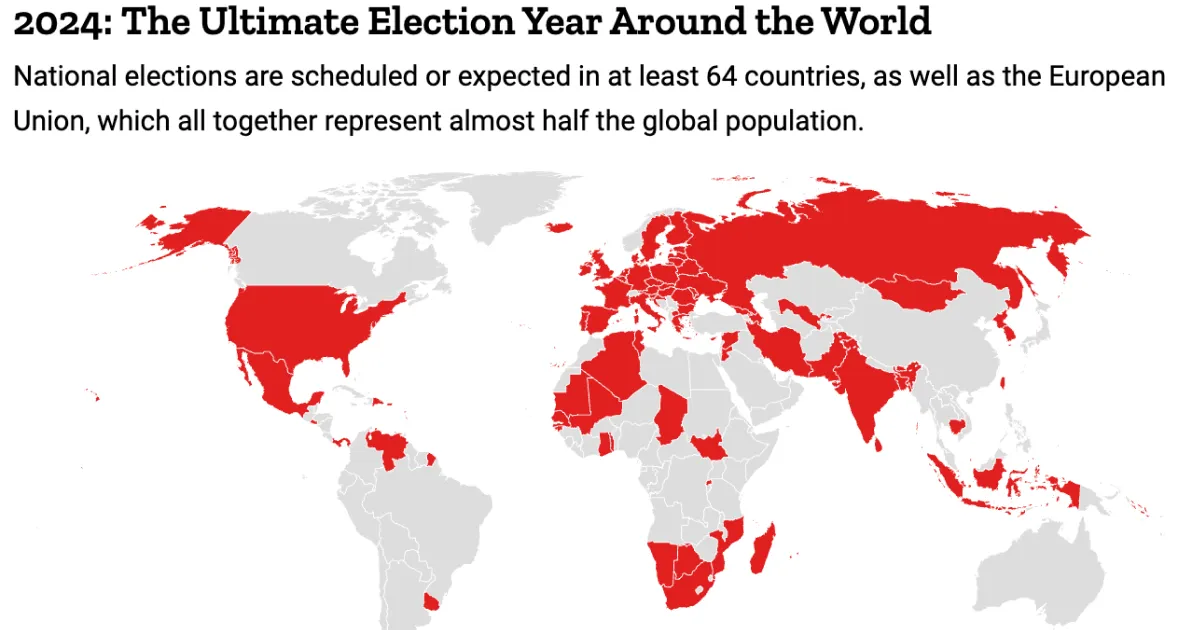

In our Q&A with Tom Linton—seasoned procurement pro and supply chain author—we asked what was top of mind for him going into the new year. Tom notes, “The U.S. election will have a significant impact.” The US isn’t the only country holding an election, either. In fact, over 50 countries will go to the polls in 2024, including Taiwan’s election for president and 113 legislature members and the next general election in the UK to determine the composition of the House of Commons (which decides the next Government of the UK).

With transitions of power come periods of uncertainty and potential risk as new legislative agendas take shape. In the U.S., supply chain resilience was a key focus in 2023. The question arises: will supply chain initiatives remain a priority under a new administration? This uncertainty extends globally to other election-bound nations. Supply chain managers must vigilantly monitor evolving policies and legislation that could impact their operations, sourcing, and materials, especially in countries with imminent elections.

US-China tensions have heightened and will continue to be a risk in 2024. The United States’ export restrictions on China, particularly in the technology sector due to intellectual property concerns, has intensified trade tensions between the two economic giants. The trade of Liquified Natural Gas (LNG) between the US and China has become a crucial factor influencing their relations. China has evolved as a major importer of US LNG, giving the country considerable leverage over the US energy sector.

In turn, China has implemented its own set of export restrictions, further complicating the global economic landscape. Notably, as of December 2023, China mandates export permits for specific types of graphite, citing national security concerns. Graphite is crucial to electric vehicles and semiconductor manufacturing. China produced 61% of graphite globally, amplifying the impact of these export controls.

In 2023, China also imposed controls on gallium and germanium—vital earth metals crucial for semiconductor production—which has caused a significant surge in commodity prices.

Tensions between China and Taiwan have shined a spotlight on TSMC, the largest global supplier of semiconductors, accounting for 55% of the world’s chip supply chain. What would happen if China invaded Taiwan? If TSMC were to shut down, it could cost the world’s economy over $1 trillion in losses, wreaking havoc on global supply chains.

Already this year, Taiwan has dismissed China’s warnings, handing its ruling party a historic third consecutive presidential win. Experts believe these actions may lead to a Chinese blockade or “quarantine” of the island—where commercial routes are stifled. Learn how this situation poses a risk to semiconductors in our special report: China-Taiwan Risks to the Global Semiconductor Industry.

According to EY, even though geopolitical risk continues to grow, corporate attention to geopolitics is shrinking. This is concerning, considering the far-reaching impact of geopolitical disruptions on a business. If your company isn’t paying attention to the geopolitical climate, it’s time to start now. Jumpstart your entire supply chain risk management program by catching up on the latest supply chain data and trends.

In our annual report, “Ascension,” we share our exclusive annual supply chain data with expert insights on what this data means for procurement professionals in 2024. Hear from the experts at Resilinc and learn how to mitigate potential geopolitical risks and more this year. Download our annual report here: Ascension: Annual Supply Chain Report 2023.

The post Keep These 6 Geopolitical Supply Chain Risks on Your Radar in 2024 appeared first on Resilinc.

In 2023—if it wasn’t already—geopolitics became top of mind for every procurement professional. With the ongoing war between Russia and Ukraine, the Israel-Hamas War, and the crisis in the Red Sea, the shockwaves these conflicts sent throughout their nations and the world have been felt everywhere—especially in the supply chain. As a supply chain manager, it is impossible (and unwise) to ignore the state of global politics, as it directly impacts nearly every level of the supply chain, from increased shipping rates to access to critical materials and minerals.

In fact, geopolitics is one of the top five supply chain megatrends this year, which we cover in our highly-anticipated annual report. This year, managers and procurement professionals must stay incredibly diligent when it comes to the latest news. In this blog, we uncover the top geopolitical supply chain risks of 2024 so you can proactively prepare your supply chain.

1. The Red Sea Crisis

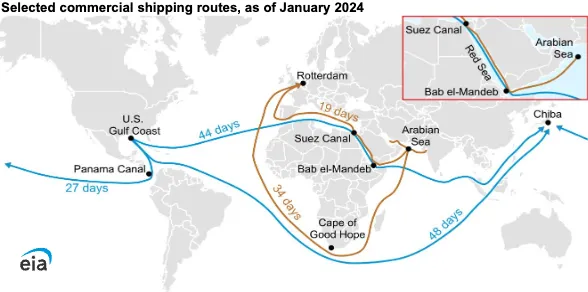

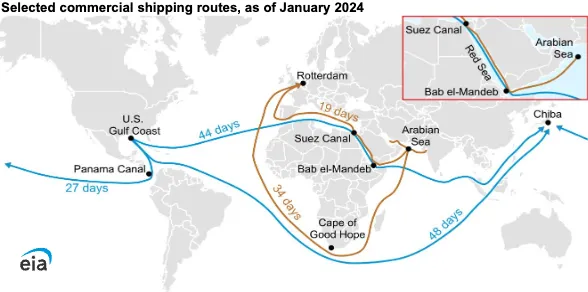

Rerouting ships around the Cape of Good Hope has caused significant shipping delays, leading to increased prices and gaps in the supply chain (U.S. Energy Information Administration).

The attacks launched by Yemen’s Houthi group on cargo ships in the Bab al Mandeb Strait at the southern end of the Red Sea have caused several major global shipping and oil companies – including Maersk and British Petroleum (BP) – to suspend shipments and halt operations in the area.

Now, ships are avoiding Egypt’s Suez Canal, the shortest maritime route from Europe to Asia and one of the world’s most important waterways, which accounts for about 12% of the world’s shipping traffic. This is causing longer journeys, which have added costs, increased oil prices, and increased insurance premiums.

Hear what Resilinc CEO, Bindiya Vakil, has to say about rising container rates, the latest in the Red Sea, and the impact on global supply chains. Watch the segment on Bloomberg above.

2. Israel-Hamas War

The Israel-Hamas war has posed a serious threat to the global supply chains. Ports in Israel, including the Port of Ashkelon, are strained, resulting in suspended operations and escalated ocean shipping premiums multiplied tenfold. If a prolonged shutdown occurs, it could squeeze the already tight global gas market. Additionally, the high-tech industry, one of Israel’s top GDP contributors, faces serious concerns as close to 500 multinational companies operate in Israel, including Intel and Tower Semiconductor.

Learn about the potential effects of the Israel-Hamas war across industries and commodities. This report shares our expert-backed best practices to protect your supply chain. Download the special report here: Israel-Hamas War: Expert Insights and Best Practices to Mitigate Disruptions.

3. Russia-Ukraine War and Russia-NATO Tensions

The Russia-Ukraine conflict, now surpassing 700 days, has become a catalyst for global supply chain disruptions, aggravated by the imposition of sanctions affecting critical commodities like oil and natural gas.

Nations, including the US, the UK, Canada, Ukraine, and the EU, have enacted sanctions against Russia and price caps on Russian oil products. Given Russia’s pivotal role as a major exporter of energy and raw materials, these measures have reverberated across vital sectors such as energy, high tech, aerospace, defense, and transportation, amplifying the impact of the conflict on the global economy.

Read more about the sanctions against Russia and the supply chain impact: Russian Sanctions: Navigating Supply Chain Impacts and Potential Outlook.

4. U.S. Election and Global Elections

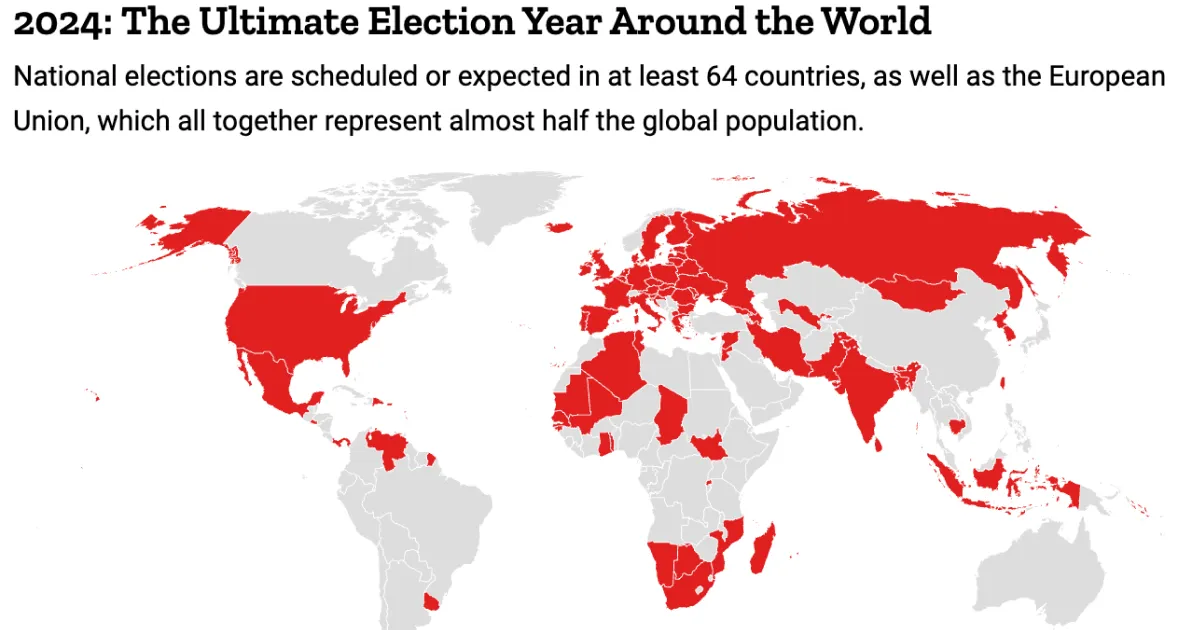

Globally, more voters than ever in history will head to the polls. This includes at least 64 countries, representing almost 50% of the global population (Time Magazine.)

In our Q&A with Tom Linton—seasoned procurement pro and supply chain author—we asked what was top of mind for him going into the new year. Tom notes, “The U.S. election will have a significant impact.” The US isn’t the only country holding an election, either. In fact, over 50 countries will go to the polls in 2024, including Taiwan’s election for president and 113 legislature members and the next general election in the UK to determine the composition of the House of Commons (which decides the next Government of the UK).

With transitions of power come periods of uncertainty and potential risk as new legislative agendas take shape. In the U.S., supply chain resilience was a key focus in 2023. The question arises: will supply chain initiatives remain a priority under a new administration? This uncertainty extends globally to other election-bound nations. Supply chain managers must vigilantly monitor evolving policies and legislation that could impact their operations, sourcing, and materials, especially in countries with imminent elections.

5. US-China Tensions and Critical Minerals

US-China tensions have heightened and will continue to be a risk in 2024. The United States’ export restrictions on China, particularly in the technology sector due to intellectual property concerns, has intensified trade tensions between the two economic giants. The trade of Liquified Natural Gas (LNG) between the US and China has become a crucial factor influencing their relations. China has evolved as a major importer of US LNG, giving the country considerable leverage over the US energy sector.

In turn, China has implemented its own set of export restrictions, further complicating the global economic landscape. Notably, as of December 2023, China mandates export permits for specific types of graphite, citing national security concerns. Graphite is crucial to electric vehicles and semiconductor manufacturing. China produced 61% of graphite globally, amplifying the impact of these export controls.

In 2023, China also imposed controls on gallium and germanium—vital earth metals crucial for semiconductor production—which has caused a significant surge in commodity prices.

6. China-Taiwan Tensions

Tensions between China and Taiwan have shined a spotlight on TSMC, the largest global supplier of semiconductors, accounting for 55% of the world’s chip supply chain. What would happen if China invaded Taiwan? If TSMC were to shut down, it could cost the world’s economy over $1 trillion in losses, wreaking havoc on global supply chains.

Already this year, Taiwan has dismissed China’s warnings, handing its ruling party a historic third consecutive presidential win. Experts believe these actions may lead to a Chinese blockade or “quarantine” of the island—where commercial routes are stifled. Learn how this situation poses a risk to semiconductors in our special report: China-Taiwan Risks to the Global Semiconductor Industry.

Is Your Supply Chain Ready for These Geopolitical Risks in 2024?

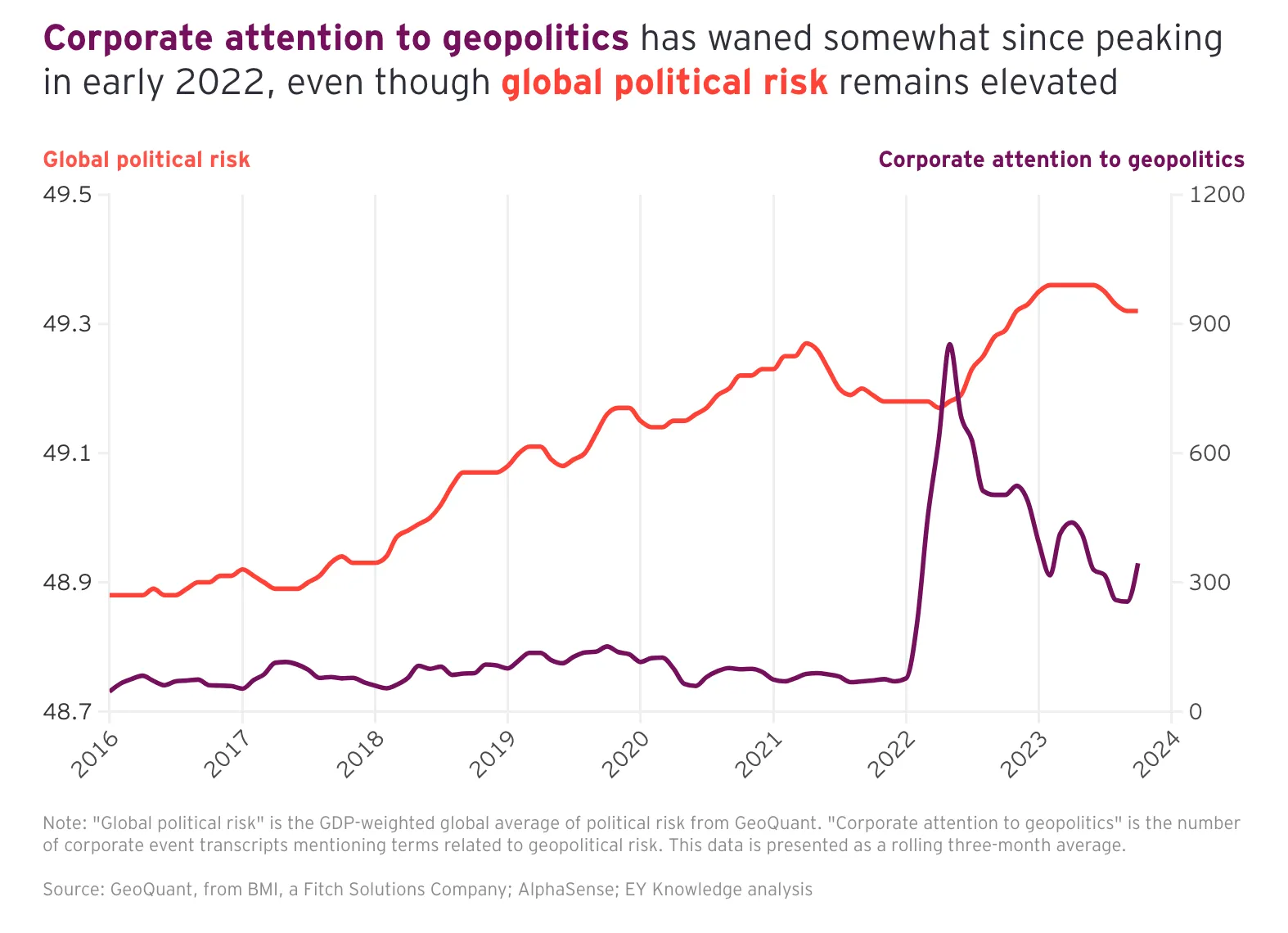

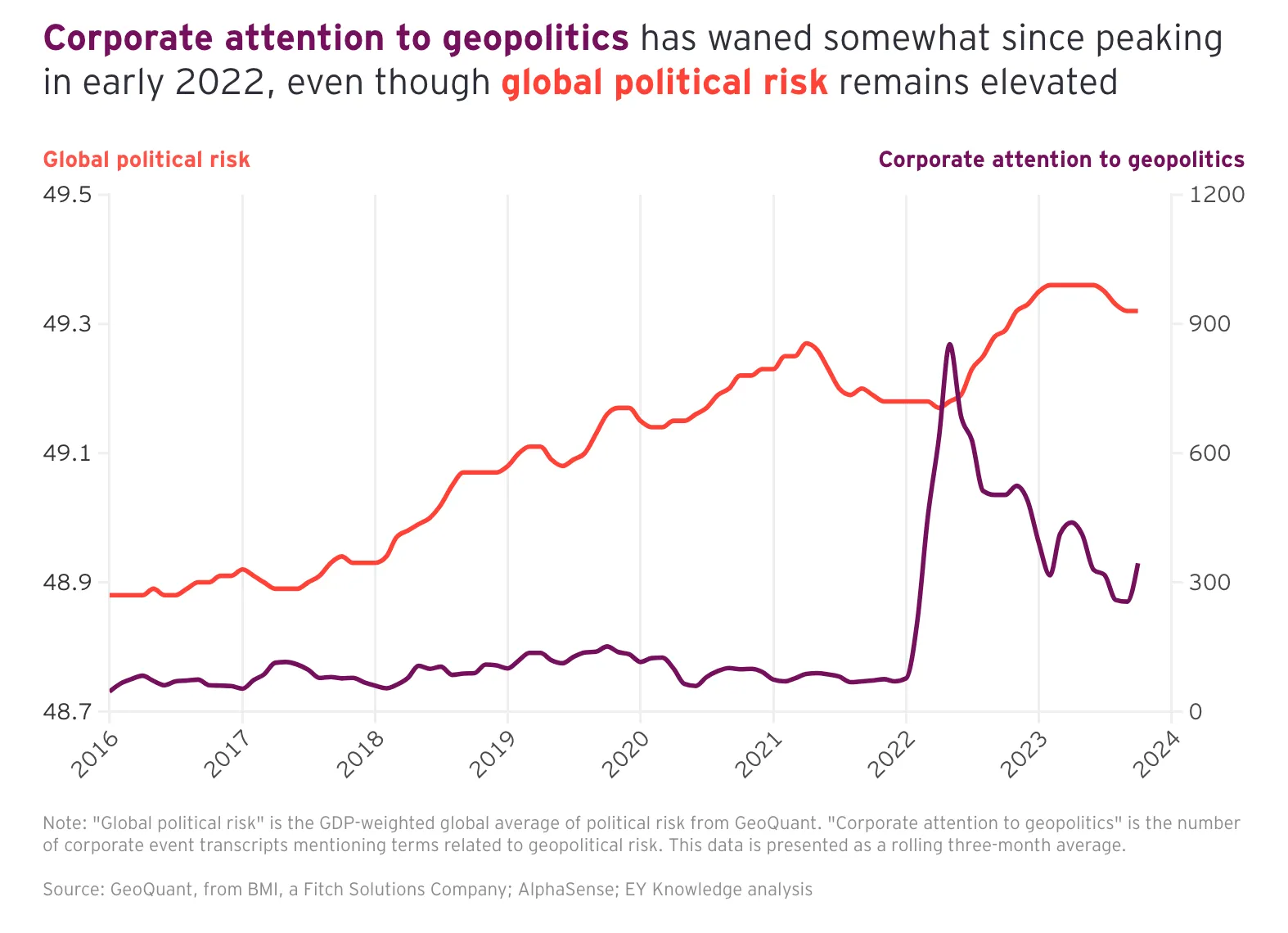

According to EY, even though geopolitical risk continues to grow, corporate attention to geopolitics is shrinking. This is concerning, considering the far-reaching impact of geopolitical disruptions on a business. If your company isn’t paying attention to the geopolitical climate, it’s time to start now. Jumpstart your entire supply chain risk management program by catching up on the latest supply chain data and trends.

In our annual report, “Ascension,” we share our exclusive annual supply chain data with expert insights on what this data means for procurement professionals in 2024. Hear from the experts at Resilinc and learn how to mitigate potential geopolitical risks and more this year. Download our annual report here: Ascension: Annual Supply Chain Report 2023.

The post Keep These 6 Geopolitical Supply Chain Risks on Your Radar in 2024 appeared first on Resilinc.